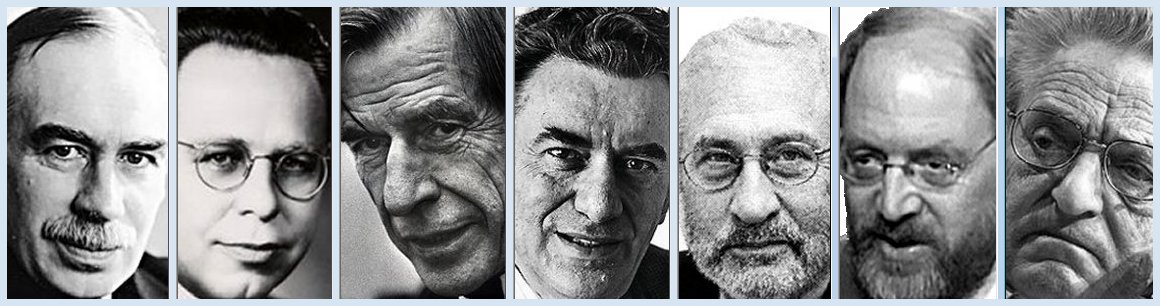

Demand Side economics may at first blush be seen as a counter to Supply Side economics, a Reagan era fad that served as pretext for trickle down policies. But Demand Side has a longer and more noble lineage. Arising from the theoretical work of John Maynard Keynes, the greatest economic mind of the past century, and from the pragmatic policies of the New Deal, Demand Side is a system that works and explains.

John Maynard Keynes and the Great Depression

The Great Depression, whatever its causes, was a contradiction to the free market capitalism as practiced in the United States and to its Classical apologists. The causes have been extensively debated, but the contradiction lies not in the advent, but in its lingering and worsening year after year. In Classical theory, a condition such as the Depression could not persist for any meaningful length of time. When the Depression did persist, the response by economists had to be either learning and adaptation or denial. There was no shortage of the latter in academia, but political reality propelled the former to the fore in the arena of public policy.

Keynes identified a paucity of effective demand as the cause of the prolonged slump. Economic activity was not returning to adequate levels because there was no impulse to draw it there. In classical theory, production itself always provided the means to purchase. This was codified in Say's Law, and adherence to it determined whether you were a legitimate economist or a crackpot. Keynes addressed his most stinging critiques to Say's Law and its totemistic Classical followers. There is no automatic stabilizing mechanism to the a market economy, he said. This is the nut of Demand Side economics: It is the strength and direction of demand which organizes and energizes a society's economy. (This means effective demand, of course, not simply an intense desire or even need, but a demand with real money behind it.)

Leon Keyserling, the New Deal and the Postwar Prosperity

Deficit spending recommended itself as well to activist economists in Franklin Roosevelt's New Deal, but from concern for the unemployed, aged, disabled and impoverished. Programs to help these groups in the absence of an ability by the government to raise sufficient revenue created the deficit spending Keynes prescribed. During the dark years of the 1930s, however, the efforts of the Deal never reached a scale sufficient to banish all doubts or completely invigorate the economy. That scale was found in World War II.

The massive government action and mobilization of the economy required by the War washed the Depression away virtually overnight. Domestic living standards actually rose even as the society's treasure poured into munitions, war machinery, massive operations across the globe - in other words, into products and services that were entirely destructive or would eventually be destroyed. In spite of nonproductive, non-consumer goods being produced on a tremendous scale, the economy also produced more consumer goods for the people on the home front.

This ratified Keynesianism, and until the middle of the 1970s, public policy was guided by a Demand Side understanding. At the same time the United States was in a favored position industrially by virtue of the destruction of the competing industry of Europe and Japan. The two converged in a broad prosperity that had never before been seen.

One of the draftsmen of the New Deal and one of the architects of the full employment that followed the war was little-known economist Leon Keyserling.

John Kenneth Galbraith and the rise of the corporate state

As was Keynes, American economist John Kenneth Galbraith was active in public service and at the same time accomplished in theory and teaching. Canadian born, but raised at Harvard, Galbraith moved into the federal government at the outset of World War II, where he directed the Office of Price Administration and was literally controller of prices in the United States. This was the second most powerful civilian post in the management of the wartime economy. Effective programs for price control were essential to keep wartime shortages from turning into crippling inflation or spawning debilitating black markets. After the war, Galbraith led the post-mortem survey and analysis of the European Theater. Under John F. Kennedy he served as ambassador to India. Often described as a maverick, Galbraith simply examined the affluence and institutional changes that were forming without the self-congratulation for the good times that followed the war. The conceit of Americans was by no means confined to economists, but the prosperity that occasioned it was based less on the imagined American virtues than on the advantage of having an infrastructure intact and an industrial capacity left undamaged by the war.

Galbraith described the rise of the corporation to dominance, the rise of government as a primary component of and actor in the economy, and the immense explosion of material prosperity that followed the War. Galbraith's writings explored a need for institutional counterweights to the Corporate Oligarchy - unions, governmental oversight, regulations, and social insurance. His foundational New Industrial State defined the part of the economy dominated by the large corporations as the Industrial System. This was the chief trait of the new industrial state. While previously corporations had rule industries where scale of operations required bigness, Galbraith saw that they had moved into other parts of the economy as well. This pervasiveness is even more apparent today than when Galbraith wrote in 1967. The New Industrial State dissected the Corporate Oligarchy, the technical reasons for its arising, the group think which he called the Technostructure, its goals, how it determined prices and controlled markets, and its ever more involved relationship with the state.

The direct look Galbraith took at the American scene contrasted starkly with the approach taken by the Conservative economic schools (Monetarist, Neoclassical, Neoliberal, Supply Side schools). These began and ended with neat and simple theory and assumed away inconvenient reality, ignoring the power and even the presence of the Corporate Oligarchy. The resulting world did not exist, but at least it was marked by healthy free competition. The popularity of these schools derived from their political convenience, to their appeal to a resurgent conservative bloc (particularly after the Vietnam War) and to eager sponsorship from the very corporations whose power they failed to acknowledge.

Hyman Minsky and the Rise of Economic Instability

Joseph Stiglitz and Globalization

Not only did the poor get poorer in the United States (in inflation-adjusted, or "real," terms) beginning in the late 1970s, but also around the globe, particularly in Africa and Latin America. Some Asian economies did begin to develop, but others struggled. Remarkable successes have been scored by China, Japan, South Korea, and others. Tragedies have occurred in Africa and Latin America. It was no coincidence that the economic troubles of these countries followed their adoption of the charts of the free marketeers. The conservative thinking that had failed so well within the United States failed even better in these countries. Those under the sponsorship of the dominant corporations fell extremely hard. This international situation has been the context for the work of Joseph E. Stiglitz on Globalization.

Stiglitz was awarded the Nobel Prize in Economics in 2001 for work which demonstrated the shortcomings of the hypothesis of free market efficiency in the absence of perfect information. Like Keynes and Galbraith, Stiglitz contributed significantly in public life. He served as chief economist in the administration of Bill Clinton and later as senior vice president and chief economist to the World Bank. Two of his books Globalization and Its Discontents and Making Globalization Work describe the causes and conditions of a world economy in stress and unable to meet the desperate need of billions of its people.

James K. Galbraith and the Predator State

George Soros and the New Paradigm for Markets

The work of these giants of the theory and practice of economics - Keynes, Keyserling, Galbraith the elder, Minsky, Stiglitz, Galbraith the younger and Soros - informs the Demand Side economics that worked before and can work again. Unlike Neoclassical and other schools, Demand Side has developed with the society it seeks to explain. Each of these men, Minsky aside, held highly responsible positions in government or the private sector, and each contributed substantially to the advancement of understanding in the discipline of economics.

A working site for research and writing on the thinkers who developed the system that works.

Sunday, October 25, 2009

Thursday, July 30, 2009

Wednesday, July 29, 2009

Thursday, July 9, 2009

George Soros in the series of those who got it right 10.19.09

Today we look at George Soros, the billionaire investor and philanthropist, who has a view of ever expanding bubbles. Soros is notable for being rich, yet advocating normalization and structure to financial markets.

I am sometimes -- not so much recently -- asked, "If you're so smart, why aren't you rich." I point to -- or pointed to -- Soros, replying, "He's rich, why don't you listen to him?"

Soros is famous for purportedly breaking the British Pound for his own enrichment, which earned him opprobrium from both sides along the lines of, "If you're so concerned with social welfare, Mr. Soros, Why did you do such a thing?" Converted to an assertive statement, it might be, "It's all right to profit if you're greedy, but not if you have concern for others."

Let's begin from Soros most recent book, The New Paradigm for Financial Markets: The Credit Crisis of 2008 and What It Means."

It certainly is necessary to address this question of the difference between economics and a natural science.

Robert Skidelsky, Keynes most famous biographer, pointed out that if economics were a natural science it likely would have responded to the mathematical tools employed so enthusiastically on its behalf to produce some significant progress. Unlike physics or biology, it has not. Skidelsky notes we are having the same arguments today as were had in the 1930s. The exact same, down to the level of vitriol between the parties. He refers to Krugman v. the Chicago School. Look for that Skidelsky interview on Bloomberg on the Economy with Tom Keene last week.

Here in Soros we see one explanation for the resistance (near complete resistance in the Demand Side view) of economics to the mechanical tools valid for the natural sciences. Soros calls it reflexivity.

Demand Side has repeatedly referred to no independent variables within the mathematics, no closed system, hence no fulcrum from which to lever the hypothetical world. If all variables in the model are dependent upon each other, and indeed can morph into each other, there is no causal chain that mathematics can produce. It becomes radically dependent on its assumptions.

Soros is talking in a different sphere, although he describes a similar recognition he had in his early years at the London School of Economics, where assumptions were allowed in economic theory to:

As economics was forced to abandon one assumption, it replaced with others until,

...

Soros by his own admission desperately wants to be taken seriously as a philosopher. He should be. His conceptual framework brings forward the problem of understanding the world in which we exist by way of concepts that are necessarily symbols or shortcuts to reducing the mass of phenomena to a manipulable scale. I would say that the exercise leaves us relating to something that is really our own projection.

Graduating from LSE with grades too poor to gain him entry into Academia, he finally hooked on as an arbitrage trader. Soros interest in reflexivity and fallibility equipped him to handle the states of nonequilibrium, boom and bust, well enough to make one fortune after another.

And indeed, markets proved to be the perfect application of reflexivity, as market players create boom and bust by their participation, not their comprehension. Perception created reality, a reality that folded back on non-market participants in often harmful ways.

Thinking about thinking and conceptual frameworks which try to define concepts are inherently subject to contradiction. So when Soros assumes an objective aspect of reality, it may become more useful, but less accurate, just as his theory predicts. Everyday events are predictable and reflexive processes are not, he says. But it would seem that reflexivity can provide momentum in stability as well as instability.

We'll leave Soros here, well short of full development, with the note that his assessments of markets and economic dynamics when he is making his calls is often simple and often intuitive, but what he does show in his practical looks adheres broadly to demand side functionalities.

We also note for the benefit of those who have complete confidence in their economic schemes, but view forecasts as a crap shoot, that Soros passes on the observation from Popper,

I am sometimes -- not so much recently -- asked, "If you're so smart, why aren't you rich." I point to -- or pointed to -- Soros, replying, "He's rich, why don't you listen to him?"

Soros is famous for purportedly breaking the British Pound for his own enrichment, which earned him opprobrium from both sides along the lines of, "If you're so concerned with social welfare, Mr. Soros, Why did you do such a thing?" Converted to an assertive statement, it might be, "It's all right to profit if you're greedy, but not if you have concern for others."

Let's begin from Soros most recent book, The New Paradigm for Financial Markets: The Credit Crisis of 2008 and What It Means."

(p.7)

"... The central idea in my conceptual framework [is] that social events have a different structure from natural phenomena. In natural phenomena there is a causal chain that links one set of facts directly with the next. In human affairs the course of events is more complicated. Not only facts are involved, but also the participants views and the interplay between them enter into the causal chain. There is a two-way connection between the facts and opinions prevailing at any moment in time: on the one hand participants seek to understand the situation (which includes both facts and opinions); on the other, they seek to influence the situation (which again includes both facts and opinions). The interplay between the cognitive and manipulative functions intrudes into the causal chain so that the chain does not lead directly from one set of facts to the next, but reflects and affects the participants' views. Since those views do not correspond to the facts, they introduce an element of uncertainty into the course of events that is absent from natural phenomena. That element of uncertainty affects both the facts and the participants' views. Natural phenomena are not necessarily determined by scientific laws of universal validity, but social events are liable to be less so."

"... The central idea in my conceptual framework [is] that social events have a different structure from natural phenomena. In natural phenomena there is a causal chain that links one set of facts directly with the next. In human affairs the course of events is more complicated. Not only facts are involved, but also the participants views and the interplay between them enter into the causal chain. There is a two-way connection between the facts and opinions prevailing at any moment in time: on the one hand participants seek to understand the situation (which includes both facts and opinions); on the other, they seek to influence the situation (which again includes both facts and opinions). The interplay between the cognitive and manipulative functions intrudes into the causal chain so that the chain does not lead directly from one set of facts to the next, but reflects and affects the participants' views. Since those views do not correspond to the facts, they introduce an element of uncertainty into the course of events that is absent from natural phenomena. That element of uncertainty affects both the facts and the participants' views. Natural phenomena are not necessarily determined by scientific laws of universal validity, but social events are liable to be less so."

It certainly is necessary to address this question of the difference between economics and a natural science.

Robert Skidelsky, Keynes most famous biographer, pointed out that if economics were a natural science it likely would have responded to the mathematical tools employed so enthusiastically on its behalf to produce some significant progress. Unlike physics or biology, it has not. Skidelsky notes we are having the same arguments today as were had in the 1930s. The exact same, down to the level of vitriol between the parties. He refers to Krugman v. the Chicago School. Look for that Skidelsky interview on Bloomberg on the Economy with Tom Keene last week.

Here in Soros we see one explanation for the resistance (near complete resistance in the Demand Side view) of economics to the mechanical tools valid for the natural sciences. Soros calls it reflexivity.

"I explain the element of uncertainty inherent in social events by relying on the correspondence theory of truth and the concept of reflexivity....

Knowledge is represented by true statements. A statement is true if and only if it corresponds to the facts. That is what the correspondence theory of truth tells us. To establish a correspondence, the facts and the statements which refer to them must be independent of each other. It is this requirement that cannot be fulfilled when we are part of the world we seek to understand."

(p.8)

Knowledge is represented by true statements. A statement is true if and only if it corresponds to the facts. That is what the correspondence theory of truth tells us. To establish a correspondence, the facts and the statements which refer to them must be independent of each other. It is this requirement that cannot be fulfilled when we are part of the world we seek to understand."

(p.8)

Demand Side has repeatedly referred to no independent variables within the mathematics, no closed system, hence no fulcrum from which to lever the hypothetical world. If all variables in the model are dependent upon each other, and indeed can morph into each other, there is no causal chain that mathematics can produce. It becomes radically dependent on its assumptions.

Soros is talking in a different sphere, although he describes a similar recognition he had in his early years at the London School of Economics, where assumptions were allowed in economic theory to:

"produce universally valid generalizations that were comparable to those of Isaac Newton in physics."

As economics was forced to abandon one assumption, it replaced with others until,

"The assumptions became increasingly convoluted and gave rise to an imaginary world that reflected only some aspects of reality, but not others. That was the world of mathematical models describing a putative market equilibrium. I was more interested in the real world than in mathematical models, and that is what led me to develop the concept of reflexivity."

...

"I contend that rational expectations theory totally misinterprets how financial markets operate. Although rational expectations theory is no longer taken seriously outside academic circles, the idea that financial markets are self-correcting and tend toward equilibrium remains the prevailing paradigm on which the various synthetic instruments and valuation models which have come to play such a dominant role in financial markets are based. I contend that the prevailing paradigm is false and urgently needs to be replaced.

"The fact is that participants cannot base their decisions on knowledge. The two-way, reflexive connection between the cognitive and manipulative functions introduces an element of uncertainty or indeterminacy into both functions. That applies both to market participants and to the financial authorities who are in charge of macroeconomic policy and are supposed to supervise and regulate markets. The members of both groups act on the basis of an imperfect understanding of the situation in which they participate. The element of uncertainty inherent in the two-way reflexive connection ... cannot e eliminated, but our understanding, and our ability to cope with the situation, would be greatly improved if we recognized this fact."

"The fact is that participants cannot base their decisions on knowledge. The two-way, reflexive connection between the cognitive and manipulative functions introduces an element of uncertainty or indeterminacy into both functions. That applies both to market participants and to the financial authorities who are in charge of macroeconomic policy and are supposed to supervise and regulate markets. The members of both groups act on the basis of an imperfect understanding of the situation in which they participate. The element of uncertainty inherent in the two-way reflexive connection ... cannot e eliminated, but our understanding, and our ability to cope with the situation, would be greatly improved if we recognized this fact."

Soros by his own admission desperately wants to be taken seriously as a philosopher. He should be. His conceptual framework brings forward the problem of understanding the world in which we exist by way of concepts that are necessarily symbols or shortcuts to reducing the mass of phenomena to a manipulable scale. I would say that the exercise leaves us relating to something that is really our own projection.

Graduating from LSE with grades too poor to gain him entry into Academia, he finally hooked on as an arbitrage trader. Soros interest in reflexivity and fallibility equipped him to handle the states of nonequilibrium, boom and bust, well enough to make one fortune after another.

And indeed, markets proved to be the perfect application of reflexivity, as market players create boom and bust by their participation, not their comprehension. Perception created reality, a reality that folded back on non-market participants in often harmful ways.

Thinking about thinking and conceptual frameworks which try to define concepts are inherently subject to contradiction. So when Soros assumes an objective aspect of reality, it may become more useful, but less accurate, just as his theory predicts. Everyday events are predictable and reflexive processes are not, he says. But it would seem that reflexivity can provide momentum in stability as well as instability.

We'll leave Soros here, well short of full development, with the note that his assessments of markets and economic dynamics when he is making his calls is often simple and often intuitive, but what he does show in his practical looks adheres broadly to demand side functionalities.

We also note for the benefit of those who have complete confidence in their economic schemes, but view forecasts as a crap shoot, that Soros passes on the observation from Popper,

"Predictions and explanations are symmetrical and reversible."

Tuesday, June 30, 2009

Monday, June 29, 2009

James K. Galbraith in the series of those who got it right

In our series looking for the perspective of those who got it right, we turn to James K. Galbraith, son of the great economist John Kenneth Galbraith and apparently invisible to those who say nobody saw it coming.

We've promoted Galbraith's book the Predator State ad nauseum here on the podcast. Let's review a few of the anti-orthodox principles that organize that book.

One, and quoting:

Two, and continuing to quote:

And three, with a final quote:

Galbraith traces the fall of conservativism from the Reagan Revolution into the more or less overt plundering of the society by the politically well-positioned oligarchs of Big Oil, Big Pharma, Insurance, Finance, Agriculture and Media.

Galbraith in 1981 as a young director of the Congressional Goint Economic Committee organized what he called "a largely futile frontline resistance to Reaganomics." The vapid combination of Supply Side pap and Milton Friedman Monetarism resulted in immediate large deficits and the beginning of hte deindustrialization of America. (Whatever might be contested about the causes of the events, the timing is not debatable.) Earlier Galbraith drafted the Humphrey-Hawkins bill, which generated the dual mandate for the Fed, and other mechanisms that focused on full employment.

The bill was created by Representative Augustus Hawkins and Senator Hubert Humphrey and signed into law in 1978. Its full title is the Full Employment and Balanced Growth Act. As written it was a worthy successor to the most important piece of economics legislation, the Full Employment Act of 1946. As implemented, it has been a way to get the Fed Chairman before Congress a couple of times a year, but otherwise has been limited to creative footnotes. Lip service is a strong description.

In particular, the Act requires the President to set numerical goals for the economy of the next fiscal year in the Economic Report of the President and to suggest policies that will achieve these goals and requires the Chairman of the Federal Reserve to connect the monetary policy with the Presidential economic policy.

The Act sets specific numerical goals for the President to attain. By 1983, unemployment rates should be not more than 3% for persons aged 20 or over and not more than 4% for persons aged 16 or over, and inflation rates should not be over 4%. The Act allows Congress to revise these goals as time progresses. If private enterprise is lacking in power to achieve these goals, the Act expressly allows the government to create a "reservoir of public employment." These jobs are required to be in the lower ranges of skill and pay so as to not draw the workforce away from the private sector.

Coordination between fiscal policy and economic policy has not occurred, of course, and it was actually one of the accomplishments of the Reagan Revolution to drive them as far apart as they have become. Unemployment rates of 3 and 4 percent are now considered the stuff of fantasy. A public employment program?

The Reagan Revolution, whatever its tenets, resulted not in principled conservativism, but in a corporate takeover of the state, as Galbraith has described in his book. By the way, this digression on Galbraith's early work is not from the book, but our contribution with an assist from Wikipedia.

The American economic model in Galbraith's view, is not the free rein to the markets and public be damned approach of Reagan and Bush, but is the structure created by the New Deal. The institutions, Galbraith writes, "are neither purely private nor wholly public. They are not like the socialist welfare institutions of Europe, but neither are they private enterprise."

Some are supported by state spending -- entitlements, but also bank credit, credit guaranetees, and implicit guarantees, and -- Galbraith is writing prior to the massive bailouts when he says -- quote --- the expectation of rescue in the event of trouble. Mortgages, health, agriculture, and the military are some of the other areas receiving massive public subsidies.

And Galbraith is also adamant about the need for standards, which rises from the delusion that markets will produce a competitive market price. Quoting

[and]

...

[continuing]

p. 179-180

We've promoted Galbraith's book the Predator State ad nauseum here on the podcast. Let's review a few of the anti-orthodox principles that organize that book.

One, and quoting:

Because markets cannot and do not think ahead, the United States needs a capacity to plan. To build such a capacity, we must, first of all, overcome our taboo against planning. Planning is inherently imperfect, but in the absence of planning, disaster is certain.

Two, and continuing to quote:

The setting of wages and control of the distribution of pay and incomes is a social, and not a market, decision. It is not the case that technology dictates what people are worth and should be paid. Rather, society decides what the distribution of pay should be, and the technology adjusts to that configuration. Standards -- for pay but also for product and occupational safety and for the environment -- are a device whereby society fashions technology to its needs. And more egalitarian standards -- those that lead to a more just society -- also promote the most rapid and effective forms of technological change, so that there is no trade-off, in a properly designed economic policy, between efficiency and fairness.

And three, with a final quote:

At this juncture in history, the United States needs to come to grips with its position in the global economy and prepare for the day when the unlimited privilege of issuing never-to-be-paid chits to the rest of the world may come to an end. We should not hasten that day. In fact, if possible, we should delay it. We should take reasonable steps to try to keep the current system intact. But given the rot in the system, we should also be prepared for a crisis that could come up very fast. The fate of the country, and indeed the security and prosperity of the entire world, could depend on whether we are able to deal with such a crisis once it starts.

Galbraith traces the fall of conservativism from the Reagan Revolution into the more or less overt plundering of the society by the politically well-positioned oligarchs of Big Oil, Big Pharma, Insurance, Finance, Agriculture and Media.

Galbraith in 1981 as a young director of the Congressional Goint Economic Committee organized what he called "a largely futile frontline resistance to Reaganomics." The vapid combination of Supply Side pap and Milton Friedman Monetarism resulted in immediate large deficits and the beginning of hte deindustrialization of America. (Whatever might be contested about the causes of the events, the timing is not debatable.) Earlier Galbraith drafted the Humphrey-Hawkins bill, which generated the dual mandate for the Fed, and other mechanisms that focused on full employment.

The bill was created by Representative Augustus Hawkins and Senator Hubert Humphrey and signed into law in 1978. Its full title is the Full Employment and Balanced Growth Act. As written it was a worthy successor to the most important piece of economics legislation, the Full Employment Act of 1946. As implemented, it has been a way to get the Fed Chairman before Congress a couple of times a year, but otherwise has been limited to creative footnotes. Lip service is a strong description.

In particular, the Act requires the President to set numerical goals for the economy of the next fiscal year in the Economic Report of the President and to suggest policies that will achieve these goals and requires the Chairman of the Federal Reserve to connect the monetary policy with the Presidential economic policy.

The Act sets specific numerical goals for the President to attain. By 1983, unemployment rates should be not more than 3% for persons aged 20 or over and not more than 4% for persons aged 16 or over, and inflation rates should not be over 4%. The Act allows Congress to revise these goals as time progresses. If private enterprise is lacking in power to achieve these goals, the Act expressly allows the government to create a "reservoir of public employment." These jobs are required to be in the lower ranges of skill and pay so as to not draw the workforce away from the private sector.

Coordination between fiscal policy and economic policy has not occurred, of course, and it was actually one of the accomplishments of the Reagan Revolution to drive them as far apart as they have become. Unemployment rates of 3 and 4 percent are now considered the stuff of fantasy. A public employment program?

The Reagan Revolution, whatever its tenets, resulted not in principled conservativism, but in a corporate takeover of the state, as Galbraith has described in his book. By the way, this digression on Galbraith's early work is not from the book, but our contribution with an assist from Wikipedia.

The American economic model in Galbraith's view, is not the free rein to the markets and public be damned approach of Reagan and Bush, but is the structure created by the New Deal. The institutions, Galbraith writes, "are neither purely private nor wholly public. They are not like the socialist welfare institutions of Europe, but neither are they private enterprise."

Some are supported by state spending -- entitlements, but also bank credit, credit guaranetees, and implicit guarantees, and -- Galbraith is writing prior to the massive bailouts when he says -- quote --- the expectation of rescue in the event of trouble. Mortgages, health, agriculture, and the military are some of the other areas receiving massive public subsidies.

And Galbraith is also adamant about the need for standards, which rises from the delusion that markets will produce a competitive market price. Quoting

"As economic theorists know, the real world is necessarily devoid of any such thing [as a competitive market price]. If there is one administered, or controlled, or monopolistic price in the system -- an oil price or an interest rate -- then even if all the other markets are perfectly competitive, all of them will be "distorted" by the presence of that one monopolistic price ...

[and]

The fact is that monopoly and market power are not only pervasive, they are at the center of economic life. The very purpose of a new technology is, of course, to create a monopoly where none previously existed.

...

[continuing]

That being so, prices and wages would serve a quite different function in the real world than the market model assigns to them. Instead of being set so as to maximize efficiency in production, they are set essentially by social relations between groups of workers and by the pattern of prices that are explicitly controlled. They express, in other words, the preixisting matrix ...

... Seen in this light, deregulation of wages and prices ... is nothing more than a rearrangement of social power relations. And the consequences have little or nothing to do with the efficiency whereby a good or service is produced...

... Seen in this light, deregulation of wages and prices ... is nothing more than a rearrangement of social power relations. And the consequences have little or nothing to do with the efficiency whereby a good or service is produced...

p. 179-180

Tuesday, June 9, 2009

James K. Galbraith - What! Respect among political differences? Bruce Bartlett and James K. Galbraith 10.19.09

Here James K. Galbraith welcomes Bruce Bartlett into the fold. This may be overstating the situation. But it's nice that progressives (and nobody is more progressive than James K.) and conservatives (and nobody is more principled in conservativism than Bruce) can talk without throwing bricks. Here, from Bartlett's blog.

Note: I wouldn't say that I have become an advocate of a European-style welfare state; I've simply resigned myself to its inevitability. If we are going to have one then I think it should be properly financed. BB

Galbraith on Bartlett

Last night James K. Galbraith hosted a forum on the firedoglake website about my new book. Jamie is now a professor of economics at the University of Texas at Austin, but back in the early 1980s he and I alternated as executive directors of the Joint Economic Committee of Congress. Following is Jamie's introduction to the forum. BB

In January 1981, Bruce Bartlett and I took over direction of the staff of the Joint Economic Committee -- he on the Republican and I on the Democratic side. Our situation was unique: a bicameral committee, evenly divided between Democrats and Republicans, no majority either way. This, at the start of the Reagan revolution, which he favored and I opposed.

Bruce was a resolute supply-sider, having drafted the Kemp-Roth tax cuts. I was a resolute Keynesian, who had helped draft the Humphrey-Hawkins Full Employment Act. His specialty was taxation, mine was monetary policy. We were both twenty-nine years old.

Stalemate would have been possible but we took a different path, creating flexible subcommittees and turning the JEC into an open forum on every economic issue. The result was an exceptionally productive two years, and an enduring friendship - though we agreed on nothing then and not all that much even now.

Bruce's views are, in my view, romantic: he is (or was, until this book) a small-government conservative and a fiscal hawk. But he thinks deeply and writes honestly -- something that is not easy to do without tenure. For his apostasy in the matter of George W. Bush, some years back, Bruce paid with his job.

It would appear however that apostasy is an acquired taste. In The New American Economy Bruce ladles it out with gusto, and with a message that should cause an entire generation of the American Right true heartburn. The message? That John Maynard Keynes was really one of their own.

John Maynard Keynes? The John Maynard Keynes? How can this possibly be?

Bruce's dark secret, here exposed, is that he is primarily a historian. He has a keen interest in the musty words of thinkers from a past day, and he actually goes off to read them. A good part of The New American Economy concerns itself with the old American economy -- the economy that collapsed in the Depression and that was revived-or, more accurately, rebuilt-in the New Deal.

Though English, Keynes was central to the ferment of New Deal ideas. Bruce here admirably introduces him as, among other things, the greatest enemy communism had in those years. Why? Because Keynes understood that if capitalism were not saved, revolution would result -- and because he felt that revolution would be worse. Drastic measures were therefore justified, whatever the business leaders of the day thought. As Bruce notes, this assessment agrees with one made decades back by my father [John Kenneth Galbraith], who characterized FDR's motives in similar terms.

Bruce takes up JKG on another point, his 1965 testimony to the Joint Economic Committee on the tax cut bill of the previous year, which my father had opposed. "There was a danger," he said, "that conservatives, once introduced to the delights of tax reduction, would like it too much. Tax reduction would then become a substitute for increased outlays on urgent social needs. We would then have a new and reactionary form of Keynesianism with which to contend."

And so it happened. The Reagan period takes up much of this book. It is interesting in large part because of the wars that broke out between conservatives once the postwar American Keynesian liberals had been swept out of the way. Much of this is highly arcane, and to understand it, it helps to have been there, as monetarists, supply-siders, fiscal conservatives, free-marketeers and pro-business corporatists battled it out.

Bruce is a first-hand witness, and quite a good one -- though not disinterested. In particular he makes a persuasive case (to me) that the leading supply-siders were not charlatans. They were, rather, for the most part idealists, who took their cues from what was then reputable thought in mainstream economics. (This, of course, raises a question as to whether the mainstream economists were charlatans, but let's leave that one alone here.)

Still, there was an interesting practical convergence between supply-side and Keynesian perspectives. In public the supply-siders reviled the "discredited Keynesians," and insisted that their tax cuts were all about "incentives to work save and invest." But in private even Reagan's own top economic adviser, Murray Weidenbaum, admitted in 1981 that the tax cuts would provide a powerful economic stimulus, Keynes-style, once the recession was past and the president was gearing up for re-election.

Given that the (Galbraithian) alternative of public investment and a stronger welfare state was not a political possibility, the choice then was between a tax cut-fueled boom and prolonged stagnation. One can argue -- I do argue -- that by reconciling Keynes with the interests of the rich, the supply-siders made the country more prosperous than it would otherwise have been. They also kept the Republican Party in business. It is true therefore that Reagan's tax cuts replicated Kennedy's success in 1964.

When Bruce turns his eye to the present crisis, he confronts a Republican Party in a near-vegetative state, able at best to blink and mutter "tax cut" in the face of any and all problems. He suggests, sensibly, that the lesson of the debacle of Bush's Social Security privatization scheme be accepted: the welfare state is here to stay. He argues (again as my father once did) in favor of a Value-Added Tax to provide a stable, admittedly regressive, pro-saving funding source. Thus Bruce Bartlett becomes an advocate of the European-style tax-and-welfare state!

Here, we again part company on the merits. For Bruce, our key economic problem going forward is an insufficiency of saving and the supposed burden of public debt. For me, it's a lack of investment, and of jobs, brought on by the debacle of private debt and a disastrously deregulated and corrupted financial sector. I'm not a fan of the European solution -- among other things it leaves savings idle, unemployment high and education (in particular) underfunded. I like the progressive income tax and even more the estate tax, which spur philanthropy and fuel our vast non-profit sector. I think Social Security is the best part of the American welfare state -- and one of the most successful public pension programs in the world.

Back to the trenches, Bruce?

Note: I wouldn't say that I have become an advocate of a European-style welfare state; I've simply resigned myself to its inevitability. If we are going to have one then I think it should be properly financed. BB

Saturday, May 30, 2009

Friday, May 29, 2009

Saturday, May 9, 2009

Joseph Stiglitz on the question of incentives 10.21.09

In this piece, Stiglitz contrasts the career of Norman Borlaug to that of the nameless Wall Street bankers, and wonders whether some noble people are corrupted by the immense money to be made in finance. The question goes beyond this, as must be plain by now. The incentives themselves were corrupting, not only of the people, but they suborned criminal and near criminal unconsciousness of the public's welfare. You don't get rich by doing the right thing on Wall Street. Of course, many have clothed themselves in the invisible hand, a myth to which even Stiglitz gives too much credit.. It is less than a fig leaf. Here is Stiglitz.

Borlaug and the Bankers

Joseph E. Stiglitz

Project Syndicate

October 20, 2009

NEW YORK – The recent death of Norman Borlaug provides an opportune moment to reflect on basic values and on our economic system. Borlaug received the Nobel Peace Prize for his work in bringing about the “green revolution,” which saved hundreds of millions from hunger and changed the global economic landscape.

Before Borlaug, the world faced the threat of a Malthusian nightmare: growing populations in the developing world and insufficient food supplies. Consider the trauma a country like India might have suffered if its population of a half-billion had remained barely fed as it doubled. Before the green revolution, Nobel Prize-winning economist Gunnar Myrdal predicted a bleak future for an Asia mired in poverty. Instead, Asia has become an economic powerhouse.

Likewise, Africa’s welcome new determination to fight the war on hunger should serve as a living testament to Borlaug. The fact that the green revolution never came to the world’s poorest continent, where agricultural productivity is just one-third the level in Asia, suggests that there is ample room for improvement.

The green revolution may, of course, prove to be only a temporary respite. Soaring food prices before the global financial crisis provided a warning, as does the slowing rate of growth of agricultural productivity. India’s agriculture sector, for example, has fallen behind the rest of its dynamic economy, living on borrowed time, as levels of ground water, on which much of the country depends, fall precipitously.

But Borlaug’s death at 95 also is a reminder of how skewed our system of values has become. When Borlaug received news of the award, at four in the morning, he was already toiling in the Mexican fields, in his never-ending quest to improve agricultural productivity. He did it not for some huge financial compensation, but out of conviction and a passion for his work.

What a contrast between Borlaug and the Wall Street financial wizards that brought the world to the brink of ruin. They argued that they had to be richly compensated in order to be motivated. Without any other compass, the incentive structures they adopted did motivate them – not to introduce new products to improve ordinary people’ lives or to help them manage the risks they faced, but to put the global economy at risk by engaging in short-sighted and greedy behavior. Their innovations focused on circumventing accounting and financial regulations designed to ensure transparency, efficiency, and stability, and to prevent the exploitation of the less informed.

There is also a deeper point in this contrast: our societies tolerate inequalities because they are viewed to be socially useful; it is the price we pay for having incentives that motivate people to act in ways that promote societal well-being. Neoclassical economic theory, which has dominated in the West for a century, holds that each individual’s compensation reflects his marginal social contribution – what he adds to society. By doing well, it is argued, people do good.

But Borlaug and our bankers refute that theory. If neoclassical theory were correct, Borlaug would have been among the wealthiest men in the world, while our bankers would have been lining up at soup kitchens.

Of course, there is a grain of truth in neoclassical theory; if there weren’t, it probably wouldn’t have survived as long as it has (though bad ideas often survive in economics remarkably well). Nevertheless, the simplistic economics of the eighteenth and nineteenth centuries, when neoclassical theories arose, are wholly unsuited to twenty-first-century economies. In large corporations, it is often difficult to ascertain the contribution of any individual. Such corporations are rife with “agency” problems: while decision-makers (CEO’s) are supposed to act on behalf of their shareholders, they have enormous discretion to advance their own interests – and they often do.

Bank officers may have walked away with hundreds of millions of dollars, but everyone else in our society – shareholders, bondholders, taxpayers, homeowners, workers – suffered. Their investors are too often pension funds, which also face an agency problem, because their executives make decisions on behalf of others. In such a world, private and social interests often diverge, as we have seen so dramatically in this crisis.

Does anyone really believe that America’s bank officers suddenly became so much more productive, relative to everyone else in society, that they deserve the huge compensation increases they have received in recent years? Does anyone really believe that America’s CEO’s are that much more productive than those in other countries, where compensation is more modest?

Worse, in America stock options became a preferred form of compensation – often worth more than an executive’s base pay. Stock options reward executives generously even when shares rise because of a price bubble – and even when comparable firms’ shares are performing better. Not surprisingly, stock options create strong incentives for short-sighted and excessively risky behavior, as well as for “creative accounting,” which executives throughout the economy perfected with off-balance-sheet shenanigans.

The skewed incentives distorted our economy and our society. We confused means with ends. Our bloated financial sector grew to the point that in the United States it accounted for more than 40% of corporate profits.

But the worst effects were on our human capital, our most precious resource. Absurdly generous compensation in the financial sector induced some of our best minds to go into banking. Who knows how many Borlaugs there might have been among those enticed by the riches of Wall Street and the City of London? If we lost even one, our world was made immeasurably poorer.

Joseph Stiglitz - Thanks to the Deficit, the Buck Stops Here - 08.29.09

Stiglitz: Thanks to the Deficit, the Buck Stops Here

from Economist's View by Mark Thoma

Joseph Stiglitz repeats a warning that he and others have made in the past that, like it or not, the dollar's days as a reserve currency are numbered. Thus, instead of resisting this change -- as we have -- "it's better for us to participate in the construction of a new system than have it happen without us":Thanks to the Deficit, the Buck Stops Here, by Joseph E. Stiglitz, Commentary, Washington Post: Beware of deficit fetishism. Last week we learned that the national debt is likely to grow by more than $9 billion. That's not great news -- no one likes a big deficit -- but President Obama inherited an economic mess from the Bush administration, and the cleanup comes with an inevitably high price tag. We're paying it now. ...

There are ... consequences, however, that we're missing in the debate over all this red ink. Our budget deficit, as well as the Federal Reserve's ballooning lending programs and other financial obligations, will accelerate a process already well underway -- a changing role for the U.S. dollar in the global economy.

The domino effect is straightforward: Higher deficits spark market concerns over future inflation; concerns of inflation contribute to a weaker dollar; and both come together to undermine the greenback's role as a reliable store of value around the world. ...

Anxieties about future inflation can lead to a weaker dollar today. So, are these anxieties justifiable? ... The worries are justified, even though Fed Chairman Ben Bernanke ... assures us that he will deftly manage monetary policy... This is a tough balancing act... Anyone looking at the Fed's record in recent years will be skeptical of its forecasting skills and its ability to get the balance right.

In addition, international markets understand that the United States may face strong incentives to reduce the real value of its debts through inflation...

Like it or not, out of the ashes of this debacle a new and more stable global reserve system is likely to emerge, and for the world as a whole, as well as for the United States, this would be a good thing. It would lead to a more stable worldwide financial system and stronger global economic growth. ... Discussions on the design of the new system are already underway. ...

The United States has resisted these changes, but they will come regardless, and it's better for us to participate in the construction of a new system than have it happen without us. The United States has seen great advantages with the dollar as the world's reserve currency..., particularly the ability to borrow at low interest rates seemingly without limit. But we haven't seen the costs as clearly: the inevitable trade deficits, the instability, the weaker global economy. The benefits to us are likely to shrink, and rapidly so, as countries shift their holdings away from the dollar. ...

America should show leadership in helping shape this new structure and managing the transition, rather than burying its head in the sand. We may have preferred to keep the old system, in which the dollar reigned supreme, but that's no longer an option.

Joseph Stiglitz - Stimulate or Die - 08.15.09

Stimulate or Die

Joseph E. Stiglitz

English Spanish Russian French German Czech Chinese Arabic

print recommend Send link clip clip secure rights secure rights

A larger | smaller

all comments (4)

close

DIGG.comSLASHDOT.orgREDDIT.comNETSCAPE.comFURL.netdel.icio.usSTUMBLEUPON.comtechnorati.comsquidoo.comswik.NETyahoomywebGoogleLIVE.comFacebookTwitter

NEW YORK – As the green shoots of economic recovery that many people spied this spring have turned brown, questions are being raised as to whether the policy of jump-starting the economy through a massive fiscal stimulus has failed. Has Keynesian economics been proven wrong now that it has been put to the test?

That question, however, would make sense only if Keynesian economics had really been tried. Indeed, what is needed now is another dose of fiscal stimulus. If that does not happen, we can look forward to an even longer period in which the economy operates below capacity, with high unemployment.

The Obama administration seems surprised and disappointed with high and rising joblessness. It should not be. All of this was predictable. The true measure of the success of the stimulus is not the actual level of unemployment, but what unemployment would have been without the stimulus. The Obama administration was always clear that it would create some three million jobs more than what would otherwise be the case. The problem is that the shock to the economy from the financial crisis was so bad that even Obama’s seemingly huge fiscal stimulus has not been enough.

But there is another problem: In the United States, only about a quarter of the almost $800 billion stimulus was designed to be spent this year, and getting it spent even on “shovel ready” projects has been slow going. Meanwhile, US states have been faced with massive revenue shortfalls, exceeding $200 billion. Most face constitutional requirements to run balanced budgets, which means that such states are now either raising taxes or cutting expenditures –a negative stimulus that offsets at least some of the Federal government’s positive stimulus.

At the same time, almost one-third of the stimulus was devoted to tax cuts, which Keynesian economics correctly predicted would be relatively ineffective. Households, burdened with debt while their retirement savings wither and job prospects remain dim, have spent only a fraction of the tax cuts.

In the US and elsewhere, much attention was focused on fixing the banking system. This may be necessary to restore robust growth, but it is not sufficient. Banks will not lend if the economy is in the doldrums, and American households will be particularly reluctant to borrow – at least in the profligate ways they borrowed prior to the crisis. The almighty American consumer was the engine of global growth, but it will most likely continue to sputter even after the banks are repaired. In the interim, some form of government stimulus will be required.

Some worry about America’s increasing national debt. But if a new stimulus is well designed, with much of the money spent on assets, the fiscal position and future growth can actually be made stronger.

It is a mistake to look only at a country’s liabilities, and ignore its assets. Of course, that is an argument against badly designed bank bailouts, like the one in America, which has cost US taxpayer hundreds of billions of dollars, much of it never to be recovered. The national debt has increased, with no offsetting asset placed on the government’s balance sheet. But one should not confuse corporate welfare with a Keynesian stimulus.

A few (not many) worry that this bout of government spending will result in inflation. But the more immediate problem remains deflation, given high unemployment and excess capacity. If the economy recovers more robustly than I anticipate, spending can be canceled. Better yet, if much of the next round of stimulus is devoted to automatic stabilizers – such as compensating for the shortfall in state revenues – then if the economy does recover, the spending will not occur. There is little downside risk.

Nevertheless, there is some concern that growing inflationary expectations might result in rising long-term interest rates, offsetting the benefits of the stimulus. Here, monetary authorities must be vigilant, and continue their “non-standard” interventions – managing both short-term and long-term interest rates.

All policies entail risk. Not preparing for a second stimulus now risks a weaker economy – and the money not being there when it is needed. Stimulating an economy takes time, as the Obama administration’s difficulties in spending what it has allocated show; the full effect of these efforts may take a half-year or more to be felt.

A weaker economy means more bankruptcies and home foreclosures and higher unemployment. Even putting aside the human suffering, this means, in turn, more problems for the financial system. And, as we have seen, a weaker financial system means a weaker economy, and possibly the need for more emergency money to save it from another catastrophe. If we try to save money now, we risk spending much more later.

The Obama administration erred in asking for too small a stimulus, especially after making political compromises that caused it to be less effective than it could have been. It made another mistake in designing a bank bailout that gave too much money with too few restrictions on too favorable terms to those who caused the economic mess in the first place – a policy that has dampened taxpayers’ appetite for more spending.

But that is politics. The economics is clear: the world needs all the advanced industrial countries to commit to another big round of real stimulus spending. This should be one of the central themes of the next G-20 meeting in Pittsburgh.

Joseph E. Stiglitz

English Spanish Russian French German Czech Chinese Arabic

print recommend Send link clip clip secure rights secure rights

A larger | smaller

all comments (4)

close

DIGG.comSLASHDOT.orgREDDIT.comNETSCAPE.comFURL.netdel.icio.usSTUMBLEUPON.comtechnorati.comsquidoo.comswik.NETyahoomywebGoogleLIVE.comFacebookTwitter

NEW YORK – As the green shoots of economic recovery that many people spied this spring have turned brown, questions are being raised as to whether the policy of jump-starting the economy through a massive fiscal stimulus has failed. Has Keynesian economics been proven wrong now that it has been put to the test?

That question, however, would make sense only if Keynesian economics had really been tried. Indeed, what is needed now is another dose of fiscal stimulus. If that does not happen, we can look forward to an even longer period in which the economy operates below capacity, with high unemployment.

The Obama administration seems surprised and disappointed with high and rising joblessness. It should not be. All of this was predictable. The true measure of the success of the stimulus is not the actual level of unemployment, but what unemployment would have been without the stimulus. The Obama administration was always clear that it would create some three million jobs more than what would otherwise be the case. The problem is that the shock to the economy from the financial crisis was so bad that even Obama’s seemingly huge fiscal stimulus has not been enough.

But there is another problem: In the United States, only about a quarter of the almost $800 billion stimulus was designed to be spent this year, and getting it spent even on “shovel ready” projects has been slow going. Meanwhile, US states have been faced with massive revenue shortfalls, exceeding $200 billion. Most face constitutional requirements to run balanced budgets, which means that such states are now either raising taxes or cutting expenditures –a negative stimulus that offsets at least some of the Federal government’s positive stimulus.

At the same time, almost one-third of the stimulus was devoted to tax cuts, which Keynesian economics correctly predicted would be relatively ineffective. Households, burdened with debt while their retirement savings wither and job prospects remain dim, have spent only a fraction of the tax cuts.

In the US and elsewhere, much attention was focused on fixing the banking system. This may be necessary to restore robust growth, but it is not sufficient. Banks will not lend if the economy is in the doldrums, and American households will be particularly reluctant to borrow – at least in the profligate ways they borrowed prior to the crisis. The almighty American consumer was the engine of global growth, but it will most likely continue to sputter even after the banks are repaired. In the interim, some form of government stimulus will be required.

Some worry about America’s increasing national debt. But if a new stimulus is well designed, with much of the money spent on assets, the fiscal position and future growth can actually be made stronger.

It is a mistake to look only at a country’s liabilities, and ignore its assets. Of course, that is an argument against badly designed bank bailouts, like the one in America, which has cost US taxpayer hundreds of billions of dollars, much of it never to be recovered. The national debt has increased, with no offsetting asset placed on the government’s balance sheet. But one should not confuse corporate welfare with a Keynesian stimulus.

A few (not many) worry that this bout of government spending will result in inflation. But the more immediate problem remains deflation, given high unemployment and excess capacity. If the economy recovers more robustly than I anticipate, spending can be canceled. Better yet, if much of the next round of stimulus is devoted to automatic stabilizers – such as compensating for the shortfall in state revenues – then if the economy does recover, the spending will not occur. There is little downside risk.

Nevertheless, there is some concern that growing inflationary expectations might result in rising long-term interest rates, offsetting the benefits of the stimulus. Here, monetary authorities must be vigilant, and continue their “non-standard” interventions – managing both short-term and long-term interest rates.

All policies entail risk. Not preparing for a second stimulus now risks a weaker economy – and the money not being there when it is needed. Stimulating an economy takes time, as the Obama administration’s difficulties in spending what it has allocated show; the full effect of these efforts may take a half-year or more to be felt.

A weaker economy means more bankruptcies and home foreclosures and higher unemployment. Even putting aside the human suffering, this means, in turn, more problems for the financial system. And, as we have seen, a weaker financial system means a weaker economy, and possibly the need for more emergency money to save it from another catastrophe. If we try to save money now, we risk spending much more later.

The Obama administration erred in asking for too small a stimulus, especially after making political compromises that caused it to be less effective than it could have been. It made another mistake in designing a bank bailout that gave too much money with too few restrictions on too favorable terms to those who caused the economic mess in the first place – a policy that has dampened taxpayers’ appetite for more spending.

But that is politics. The economics is clear: the world needs all the advanced industrial countries to commit to another big round of real stimulus spending. This should be one of the central themes of the next G-20 meeting in Pittsburgh.

Thursday, April 30, 2009

Wednesday, April 29, 2009

Thursday, April 9, 2009

Hyman Minsky 03.20

And we go back to the algebra derived from Michal Kelecki's most simple assumption -- that workers consume all their income -- and see how Minsky develops it. Of course the assumption is not completely true, but it is not fatal to the analysis when it deviates the way, for example, the assumption of Neoclassical economics that all firms are price takers or the assumptions of rational expectations that market participants, indeed all economic actors, are imbued with economic omniscience.

Kalecki showed that when his assumption was allowed and in an economy with small government and little trade, investment equals profits, or profits equal investment.

By nothing more controversial than simple algebra, Minsky then demonstrated first that price is positively related to the wage rate and to the ratio of investment goods to consumption goods production, and negatively related to labor productivity. We went over that a couple of weeks ago, when we then digressed on the inappropriately prominent place the quantity theory of money has in the primitive orthodoxy that rules economics today.

But let's consider what Minsky's relationships mean. It's a no-brainer that prices vary in the opposite direction as productivity, because, productivity simply means producing more with the same labor. We at Demand Side recently demonstrated that productivity also goes up when the unemployment rate goes down. (I was so excited.) And since wages and unemployment also vary inversely, there is some amelioration of the labor cost impact on price, that is, on inflation. Put simply, prices do not rise in proportion to wages in periods of falling unemployment. This is, of course, opposite to the information derived from the famous Phillips Curve.

But the second part of this finding is very instructive. The algebra shows what we might also derive from common sense. As investment goods are emphasized over consumer goods, the price of consumer goods tends to rise, because, basically, workers in both sectors are bidding for the output of the consumer goods sector. So when the ratio favors investment goods more, demand for consumer goods is higher and output is lower.

But the implications are not all so common-sensical. The Kalecki demonstration that profits equal investment combines with this revelation that as new investment goes up, so do prices, to produce a condition in which higher prices, higher investment and higher profits coexist. Since investment also connects positively with output and income, we can expect these two -- output and income -- to be in the same virtuous soup.

This indeed was a somewhat surprising empirical finding of our research on economic performance by president. We found that in the postwar period employment is higher, unemployment lower, investment higher, corporate profits higher and GDP growth better when a Democrat is in the White House. It surprised us somewhat that with all the effort by Republicans to push companies into profitability, some would say at the expense of others, that is, the whole supply side idea, that they were not able to accomplish profits better than Democrats. The Kalecki-Minsky analysis demonstrates why it has to be. You can find it on pages 140 and following in Stabilizing an Unstable Economy.

Prices, Minsky says, carry profits, the raison d'etre for investment. In my micro courses we had fixed costs and variable costs and average costs. Prices were determined by marginal costs and where the marginal cost curve intersected the demand curve. This may be true, Minsky says, for price takers. But a whole great swath of the economy, by far its major part, is composed of firms which more or less set prices and vary output according to demand.

These firms operate on the basis of a set of nesting average cost curves, the highest of which includes capital asset validation cost, or profits in the normal use of the word. Such firms keep prices at the requisite level when demand falls by their market power, pricing power. Without this ability to constrain price movements, they may not be able to employ expensive and highly specialized capital assets and large-scale debt financing, Minsky observes.

We include that mention here not because we expect you to get it, the nesting average cost curves and so on, but just to let you know it is there in Minsky, as it is in the real world, and it informs what follows.

Returning to the propositions derived from the insights of Kelecki. Minsky expanded these by introducing big government and trade and workers who save. Elegant and simple algebra yields some remarkable insights.

Note here and we'll explain more in a minute that Minsky's profit is not the same profit with which we are familiar, nor that which we measured in our comparisons of economic performance by president.

Nevertheless, when government and taxes and deficits are introduced, something remarkable appears. It can be shown that after-tax profits equal investment plus the government deficit. When there is no investment, profits equal the deficit. See the details on page 148.

What are the implications of this? One implication is certainly that the big business types who encouraged the tax cuts to promote business should not now be bellyaching about the deficits. They are supporting profits. Now let's look at exactly what profits they are supporting.

Minsky's profits he also terms the "surplus," and it is not only the return on capital we normally think of as profit, but all the returns which are not technologically determined costs of production. These include advertising and professional services, executive salaries and overhead costs, costs of financing and the aforementioned costs to validate capital assets.

Two things jump out at me. One is that the profit or surplus feeds the white collars and presumably the big salaries as opposed to the blue collars on the production side. The other is that price-taking firms are disciplined into being more lean and less top heavy. It appeals to me as justification for taxing incomes progressively.

But let's go back to the price takers versus the price makers. What happens when demand falls? In the case of price takers, demand is reflected by a price that runs back along the marginal cost curve. In the case of price makers, who set the price and prevent its falling by market power, something else happens.

If output drops below the first critical average cost curve, capital asset prices are no longer validated and investment in new capital assets stops -- with implications across the economy for incomes and output. If output drops below the second critical curve, fixed debt payments can no longer be supported, and the various financing instruments come under pressure. Of course, the overhead and executive costs are compressed to some extent, but these may be resistant. For example, firms may increase advertising in attempts to gin up demand.

And when overall demand affects many firms, the same kinds of financial instruments come under pressure and we walk into the kind of crisis we have today.

See that the deflation is resisted by such firms on their products, because they have individual pricing power, but that the drop in output affects incomes and investments and financial arrangements dramatically -- without affecting price.

So my take here is that we ought not to be too ecstatic that deflation is not spiraling. The cost-cutting and absence of investment and the pressure on the financial sector, all too evident in the current stagnation and apparent in declining payrolls may likely mean more bad jujus.

AND of course, business cash flow is being supported mightily by government deficits.

Kalecki showed that when his assumption was allowed and in an economy with small government and little trade, investment equals profits, or profits equal investment.

By nothing more controversial than simple algebra, Minsky then demonstrated first that price is positively related to the wage rate and to the ratio of investment goods to consumption goods production, and negatively related to labor productivity. We went over that a couple of weeks ago, when we then digressed on the inappropriately prominent place the quantity theory of money has in the primitive orthodoxy that rules economics today.

But let's consider what Minsky's relationships mean. It's a no-brainer that prices vary in the opposite direction as productivity, because, productivity simply means producing more with the same labor. We at Demand Side recently demonstrated that productivity also goes up when the unemployment rate goes down. (I was so excited.) And since wages and unemployment also vary inversely, there is some amelioration of the labor cost impact on price, that is, on inflation. Put simply, prices do not rise in proportion to wages in periods of falling unemployment. This is, of course, opposite to the information derived from the famous Phillips Curve.

But the second part of this finding is very instructive. The algebra shows what we might also derive from common sense. As investment goods are emphasized over consumer goods, the price of consumer goods tends to rise, because, basically, workers in both sectors are bidding for the output of the consumer goods sector. So when the ratio favors investment goods more, demand for consumer goods is higher and output is lower.

But the implications are not all so common-sensical. The Kalecki demonstration that profits equal investment combines with this revelation that as new investment goes up, so do prices, to produce a condition in which higher prices, higher investment and higher profits coexist. Since investment also connects positively with output and income, we can expect these two -- output and income -- to be in the same virtuous soup.

This indeed was a somewhat surprising empirical finding of our research on economic performance by president. We found that in the postwar period employment is higher, unemployment lower, investment higher, corporate profits higher and GDP growth better when a Democrat is in the White House. It surprised us somewhat that with all the effort by Republicans to push companies into profitability, some would say at the expense of others, that is, the whole supply side idea, that they were not able to accomplish profits better than Democrats. The Kalecki-Minsky analysis demonstrates why it has to be. You can find it on pages 140 and following in Stabilizing an Unstable Economy.

Prices, Minsky says, carry profits, the raison d'etre for investment. In my micro courses we had fixed costs and variable costs and average costs. Prices were determined by marginal costs and where the marginal cost curve intersected the demand curve. This may be true, Minsky says, for price takers. But a whole great swath of the economy, by far its major part, is composed of firms which more or less set prices and vary output according to demand.

These firms operate on the basis of a set of nesting average cost curves, the highest of which includes capital asset validation cost, or profits in the normal use of the word. Such firms keep prices at the requisite level when demand falls by their market power, pricing power. Without this ability to constrain price movements, they may not be able to employ expensive and highly specialized capital assets and large-scale debt financing, Minsky observes.

We include that mention here not because we expect you to get it, the nesting average cost curves and so on, but just to let you know it is there in Minsky, as it is in the real world, and it informs what follows.

Returning to the propositions derived from the insights of Kelecki. Minsky expanded these by introducing big government and trade and workers who save. Elegant and simple algebra yields some remarkable insights.

Note here and we'll explain more in a minute that Minsky's profit is not the same profit with which we are familiar, nor that which we measured in our comparisons of economic performance by president.

Nevertheless, when government and taxes and deficits are introduced, something remarkable appears. It can be shown that after-tax profits equal investment plus the government deficit. When there is no investment, profits equal the deficit. See the details on page 148.

What are the implications of this? One implication is certainly that the big business types who encouraged the tax cuts to promote business should not now be bellyaching about the deficits. They are supporting profits. Now let's look at exactly what profits they are supporting.

Minsky's profits he also terms the "surplus," and it is not only the return on capital we normally think of as profit, but all the returns which are not technologically determined costs of production. These include advertising and professional services, executive salaries and overhead costs, costs of financing and the aforementioned costs to validate capital assets.

Two things jump out at me. One is that the profit or surplus feeds the white collars and presumably the big salaries as opposed to the blue collars on the production side. The other is that price-taking firms are disciplined into being more lean and less top heavy. It appeals to me as justification for taxing incomes progressively.

But let's go back to the price takers versus the price makers. What happens when demand falls? In the case of price takers, demand is reflected by a price that runs back along the marginal cost curve. In the case of price makers, who set the price and prevent its falling by market power, something else happens.

If output drops below the first critical average cost curve, capital asset prices are no longer validated and investment in new capital assets stops -- with implications across the economy for incomes and output. If output drops below the second critical curve, fixed debt payments can no longer be supported, and the various financing instruments come under pressure. Of course, the overhead and executive costs are compressed to some extent, but these may be resistant. For example, firms may increase advertising in attempts to gin up demand.

And when overall demand affects many firms, the same kinds of financial instruments come under pressure and we walk into the kind of crisis we have today.

See that the deflation is resisted by such firms on their products, because they have individual pricing power, but that the drop in output affects incomes and investments and financial arrangements dramatically -- without affecting price.